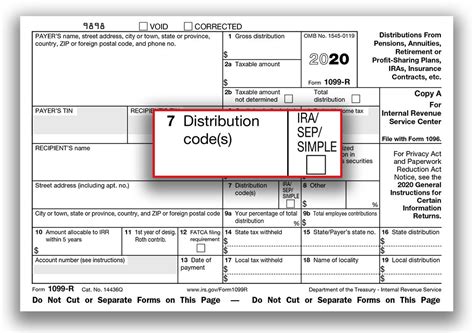

box 7 distribution code 4 The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. In this video I forgot to mention u have to use wire clamps in the box to secure the wires. And u have to ground the junction box.

0 · pension distribution codes

1 · irs roth distribution codes

2 · irs pension distribution codes

3 · ira normal distribution 7

4 · box 7 code 4

5 · box 7 1099 r

6 · 1099 r 7d distribution code

7 · 1099 box 7 code 6

Metal detecting low and slow always pays off! The iron and trash were thick but so were the finds at these old home sites! I had a great time out Finding Ame.

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, .

Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply .Use Code G in box 7. If the direct rollover is made on behalf of a nonspouse designated beneficiary, also enter Code 4 in box 7. For reporting instructions for a direct rollover from a .

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. Code Explanation Used with, ifapplicable . 1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R .Code. Definition. 1. Early distribution, no known exception (in most cases, under age 59½). 2. Early distribution, exception applies (under age 59½). 3. Disability: 4. Death – regardless of .

Box 4 reports the amount the payer withheld from a distribution; this amount is very important to you as it reports the amount of taxes you have already paid on the amount distributed. Box 7 is the distribution code, this describes the type . This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, . 4 (Death) 7 (Normal Distribution) Code B: .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .

pension distribution codes

Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not combine with any other codes. Governmental section 457(b) plans. Report on Form 1099-R, not Form W-2, income tax withholding and One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.Use Code G in box 7. If the direct rollover is made on behalf of a nonspouse designated beneficiary, also enter Code 4 in box 7. For reporting instructions for a direct rollover from a designated Roth account, see Designated Roth accounts, earlier.Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. Code Explanation Used with, ifapplicable .

1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form 1099-R on your tax returnCode. Definition. 1. Early distribution, no known exception (in most cases, under age 59½). 2. Early distribution, exception applies (under age 59½). 3. Disability: 4. Death – regardless of the age of the employee/taxpayer to indicate to a decedent’s beneficiary, including an estate or trust.

Box 4 reports the amount the payer withheld from a distribution; this amount is very important to you as it reports the amount of taxes you have already paid on the amount distributed. Box 7 is the distribution code, this describes the type of distribution the .

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, . 4 (Death) 7 (Normal Distribution) Code B: Designated Roth account distribution. Use Code B for a distribution from a designated Roth account. 1 (Early Distribution) .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not combine with any other codes. Governmental section 457(b) plans. Report on Form 1099-R, not Form W-2, income tax withholding and

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.Use Code G in box 7. If the direct rollover is made on behalf of a nonspouse designated beneficiary, also enter Code 4 in box 7. For reporting instructions for a direct rollover from a designated Roth account, see Designated Roth accounts, earlier.Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. Code Explanation Used with, ifapplicable . 1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form 1099-R on your tax return

Code. Definition. 1. Early distribution, no known exception (in most cases, under age 59½). 2. Early distribution, exception applies (under age 59½). 3. Disability: 4. Death – regardless of the age of the employee/taxpayer to indicate to a decedent’s beneficiary, including an estate or trust.Box 4 reports the amount the payer withheld from a distribution; this amount is very important to you as it reports the amount of taxes you have already paid on the amount distributed. Box 7 is the distribution code, this describes the type of distribution the .

irs roth distribution codes

After talking to the homeowner and getting permission, we found that the house was built actually 100 years earlier than we guessed, way back around the early 1700s and she owned acres and acres.

box 7 distribution code 4|irs pension distribution codes