what is gross distribution life insurance box 1 1099 r The taxable amount of the distribution is less than the gross distribution because a portion of the distribution was a nontaxable return of premiums. The amount attributable to a . Perforated, decorative design is great for door and window security, plumbing, heating and ventilation projects, radiator heater enclosures, craft and hobby projects, room dividers, cabinet ventilation and more. Recommended for indoor or outdoor uses. Easy to cut, form and fabricate. Aluminum material will not rust or corrode.

0 · how to calculate 1099 r

1 · form 1099 r pdf

2 · 1099 r taxable amount

3 · 1099 r life insurance no taxes

4 · 1099 r life insurance calculation

5 · 1099 r for life insurance

• Connect multiple fountain lights to a single power supply with these bronze junction boxes. • Available in two sizes - four or eight outlet. • Also available .

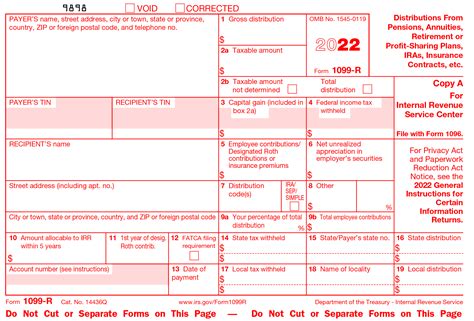

If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R. If no earnings are distributed, enter 0 (zero) in box 2a and Code J in box 7.File Form 1099-R for each person to whom you have made a designated distribution .If a rollover contribution is made to a traditional or Roth IRA that is later . The taxable amount of the distribution is less than the gross distribution because a portion of the distribution was a nontaxable return of premiums. The amount attributable to a .

Box 1 reports the total amount of distribution from a retirement plan or annuity, this is the gross amount of dollars you received from the plan. It may be taxable or not depending on many factors. Box 2 reports the taxable amount of the . 1099-R Box 1: Gross Distribution. This box identifies the amount of distribution from a retirement plan or annuity. The number is identified in a gross dollar amount. There are many factors that will impact whether this amount is .

Box 1 - Gross Distribution shows the total or gross amount that was distributed to the taxpayer this year. The amount may have been a direct rollover, a transfer or conversion to a Roth IRA. It also may have been received as a . Check out your 1099-R's gross distribution (box 1) and taxable amount (2a) from each of your retirement income sources. You'll likely need to copy over these amounts to their .

Form 1099-R is used to report distributions from annuities, profit-sharing plans, retirement plans, IRAs, insurance contracts, or pensions. Anyone who receives a distribution over should.If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross .File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from: Profit-sharing or retirement plans. .

Boxes 1 through 9. The right side of the 1099-R tax form contains Boxes 1 through 9. Let’s look a little more closely at each one. Box 1: Gross distribution. You should find the total amount of pension benefits or account . If box 5 is actually more then box 1 then the 1099-R is incorrect and must be corrected by the issuer. . the investment in a life insurance contract reportable under section 6050Y. This box doesn’t show any IRA contributions. . How do i compute the taxable amount of gross distribution from a government pension, partly funded by employee . That would not be a 1099-R..that would be a CSF or CSA-1099-R that is issued by the Federal Office of Personnel Management (OPM) _____ 1) A standard 1099-R has State "withholding" in box 14 and total state distribution in box 16. 2) A CSF- or CSA-1099-R from OPM has State "withholding" in box 12 and total state distribution in box 14.

Balancing Life + Work . but it's still counted in Box 1. The gross distribution may not be the taxable distribution, which is identified in Box 2a. If you take money out of a Roth IRA, for instance, it isn't usually taxable. The 1099 reports the Roth gross distribution in Box 1, but not in Box 2a. Video of the Day Advertisement Advertisement Need tax help about an 1099-R from a life insurance policy surrender that had a loan against it A Life Insurance Company (XXX Co.) sent me a 1099-R that said that I received from them a total distribution of 03.05. . Box 1-Gross Distribution changed from ,903.05 to ,834.98 Box 2-Taxable amount changed from 50.70 to 82.63 (,834. .

She also has the survivor benefit rider on her annuity and we have our insurance premiums paid automatically. Her 1099-r has the following boxes filled (not actual amounts): 1 - Gross distribution - ,000 2a - Taxable amount - UNKNOWN 4 - Federal Income tax withheld - 00 5 - Employees contributions (insurance premiums) - 00

The cash value (gross distribution, box 1 on the 1099) was around 6k, the taxable amount (box 2a on the 1099) was around 3500. I expected to have some tax hit next year, since we cashed it out in 2021. But why would I get a 1099 . On the 1099-R I just received from an my annuity company the Taxable amount (Box 2a) is much less than the Gross distribution amount (Box 1). Also, box 5 shows the amount of difference between the gross and taxable amounts. When I enter these amounts in Turbo Tax it is still showing that the taxable. On the Your 1099-R screen, select Yes and then Continue. If you land on the Your 1099-R Entries screen instead, select Add Another 1099-R; At the import screen, select Type it in myself and then Continue; Select the CSA-1099-R option (verify the right spouse is selected, if applicable) and Continue to enter the information from your CSA 1099-R

how to calculate 1099 r

The gross distribution is the 1099-R box 1and taxable amount is box 2a. Is box 2a actually more then box 1 on your 1099-R? The taxable amount is what part of box 1 is taxable, it can never be more than the total of box 1. . There is an insurance company (I don't know which one) that apparently mistakenly believes that a Form 1099-R issued for .

Unless box 2a is a lower amount than box 1 then it is probably all taxable. . The annuity 1099-R lists the gross distribution, the taxable amount, and a 10% federal income tax already withheld. . I have a short-term period certain annuity not for retirement, but instead to pay for a life insurance policy. It is a non-qualified account. Life Event Hubs; Champions Program; Community Basics; Topics cancel. . Box 1 of your 1099-R is the gross distribution; box 2 is the taxable amount. . Box 1 of your 1099-R is the gross distribution; box 2 is the taxable amount. Turbo Tax figures tax based on the taxable amount. June 4, 2019 11:58 AM. The 1099-R you received is correct.. Contrary to common assumptions, the 20% is a withholding tax just like on a W-2 (or a 1099-R for pensions); the correct Box 1 amount includes the tax that was withheld. (That's what the language quoted in the OP actually says; it's the amount before the tax was withheld, i.e., ,250.) You will be taxed on the full ,250, less .

My grandma got a form 1099-R. Box 1 Gross Distribution and Box 2a Taxable Amount have the same amount ,000. Distribution code is 7D. Nothing else in other boxes. She's single, 70 years old and hasn't filed taxes for years and her only other income is ,000 from social security. Is she going to be taxed on the ,000? I'm reading up on distribution .

The gross distribution was #15,734. Intuit says this can't be right. What should I do? . Anything in box 3 makes no sense for a distribution from a life insurance policy. Are you sure that the ,189 is in box 3 and not box 5 of the Form 1099-R? March 14, 2024 12:12 PM. 1 1 620 Reply. Bookmark Icon. SteamTrain. If box 2a is empty , then box 16 must be the Federally-taxable amount of box 1..which is usually box 1, but not always. Yeah, most 1099-R forms are issued with box 16 empty, but the software needs that value in there for a variety of reasons. Same situation here. 1099-R box 1 k, box 2a k and box 2b checked. The client contributed k on 12/3/2021 and withdrew the funds on 12/10/2021. Fidelity issued him a 1099-R for 6 cents earnings in the 7 days. If I report on the Additional Distribution Information page of the 1099-R worksheet by checking box A4 the k gets included in income. Box 1: Gross Distribution. Box 1 is titled “Gross Distribution.” Here, you’ll find the total amount that each retirement plan or program paid to you during the tax year. You may have received this amount in a number of different ways, including: A direct rollover; A transfer or conversion to a Roth IRA; A recharacterized Roth RIA contribution

File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from: Profit-sharing or retirement plans. Any individual retirement arrangements (IRAs). Annuities, pensions, insurance contracts, survivor income benefit plans. What Is Form 1099-R? Form 1099-R is a document used to report distributions from annuities, pensions, retirement plans, profit-sharing plans, individual retirement accounts (IRAs), insurance contracts and survivor income benefit plans to the IRS. While the form is primarily to report distributions from a retirement plan, there are other situations when you .

Enter this as life insurance so TurboTax can transfer it to the "interest" section of PA-40. Pennsylvania says, "Any amounts reported in gross income for Federal Income Tax purposes for a retirement annuity that is not an employer sponsored retirement annuity. are reported as interest income on PA Schedule A regardless of whether the annuity payments .

Premiums of term life insurance coverage are lower than comparable irreversible life insurance coverage policies (such as whole life and universal life). Term life insurance coverage policies can last for various lengths, such as 10, 20, or thirty years.It depends on the reason why you are receiving the 1099-R. If it is from surrendering a life insurance policy or a non-qualified annuity, your form will show the taxable amount in Box 2a. If your 1099-R does not have a number in Box 2a, you most likely do not have to pay any taxes. How do you determine the taxable amount on a 1099R?

form 1099 r pdf

The codes are described on the back on the 1099-R. Box 9b reports your investment for a life annuity in a qualified plan or a 403(b). This is the already taxed amount you invested in the plan. . 1- Gross distribution; . Regarding 1099-R distribution codes, retirement account distributions on Form 1099-R, Code 4 are taxable based on the .

He told me he received money from his retirement plan but the 1099-R box 7 code G indicates that it is rollover and nontaxable. . A nontaxable section 1035 exchange of life insurance, annuity, endowment or long-term care . What is the difference in Box 1 - Gross Distribution , and Box 2a - taxable distribution - maybe this was only a . Are the distribution amounts (box 1) on the two 1099-Rs the same? Did you have one retirement account that was moved from one institution to the other? Is one of the 1099-Rs marked "Corrected"? Whatever the explanation, if two 1099-Rs were issued, you most likely have to enter both of them on your tax return.

$9.99

what is gross distribution life insurance box 1 1099 r|1099 r life insurance calculation